The annual Global 100 ranking devised by independent media and research B

Corp Corporate Knights quantitatively

compares and ranks the world’s largest publicly traded companies — equally

emphasizing the impact of a company’s operations and its core products and

services on people and the planet. The ranking is based on a rigorous assessment

of 6,733 companies with more than US$1 billion in revenues.

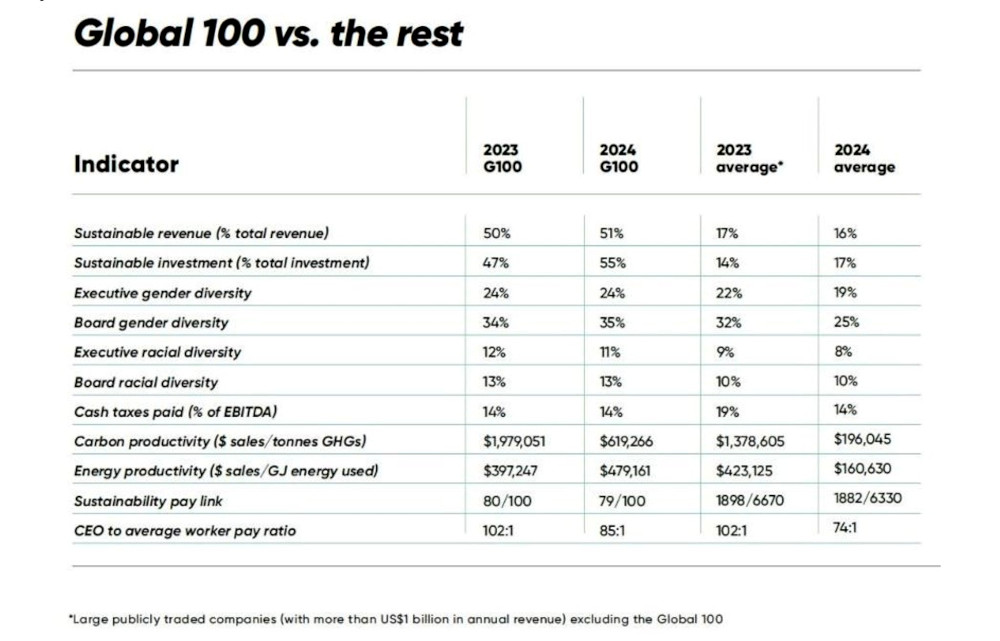

As a group, Corporate Knights’ 2024 Global

100

most sustainable corporations invested 55 percent of their capital expenditures,

research and development, and acquisitions in sustainable categories — compared

to an average of 17 percent by large companies (more than $1 billion in

revenue) overall.

“The Global 100 index has outperformed over time because Global 100 companies

back up their green commitments with their investment dollars,” says Toby

Heaps, CEO of Corporate

Knights. “Sustainable investment themes like clean energy are growing

exponentially; and the Global 100, across sectors, are help ing to drive and are

poised to thrive in the low-carbon economy.”

Global 100 companies direct three times (55 percent vs 17 percent) more capital

into sustainable investments as a percent of total investments and generate

three times (51 percent vs 16 percent) more sustainable revenue as a percent of

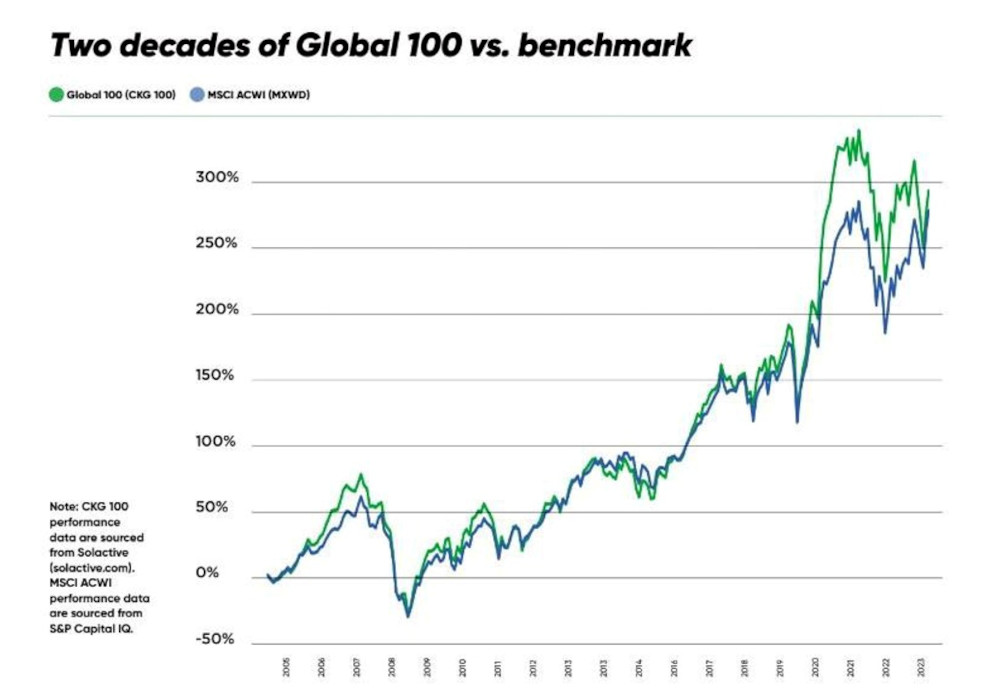

total revenue compared to the average large company. The Global 100 Index has

also continually tracked higher total returns (net USD) since its inception in

2005, returning 295 percent (vs 278 percent for the MSCI ACWI) as of the end of

2023. This is particularly notable as the Global 100 have no exposure to weapons

or traditional fossil-fuel stocks, which have suffered from geopolitical

instability over the past two years.

This year, 106-year-old Australian scrap metal recycler Sims

Ltd emerged as 2024’s most sustainable corporation.

While its environmental track record is not

pristine,

it has made significant investments and divestitures in recent years to improve

its performance — and has set targets to transition entirely to the use of

renewable energy in its shredding and separating operations by 2025, become

carbon neutral by 2030 and achieve net-zero emissions by 2050.

Matthew Malinsky, research manager

for Corporate Knights, says the increase in sustainable investment is a welcome

sign that companies are changing course.

“The fact that these companies are plowing more money into sustainable capital

expenditure and R&D means that we expect them to have higher sustainable

revenues in the near future,” he says.

What is the Global 100?

Since 2005, the Global 100 has been one of the world’s most valued and

transparent rules-based sustainability ratings that emphasizes the impact of a

company’s core products and services. It is the best-performing global

sustainability index (ticker:

CKG100),

with more than 10 years of history. All publicly traded companies with more than

US$1 billion in revenue are assessed across 25 key

performance indicators that cover resource management, employee management,

financial management, sustainable revenue and sustainable investment, and

supplier performance. Companies engaging in “red flag” activities such as

blocking climate policy and contributing to deforestation are disqualified. Its

methodology illuminates the corporate 'say–do' gap: Corporate Knights says only those

companies making sustainable solutions a core part of their business offerings

and allocating meaningful investments to reduce their carbon footprints make the

grade.

Proving the business case for a circular economy

Malinsky says that the success of two Australian companies that top the 2024

ranking — Sims Ltd and Brambles Ltd — is emblematic

of the growing number of companies associated with a circular economy, in which

waste streams become resources or new products. Sims recycles scrap metal in 30

countries, and Brambles rents recycled shipping pallets and containers around

the globe. Both companies score 100 percent on sustainable revenue and

sustainable investment.

Corporate Knights also awarded a Global 100 “pivot prize” to Italian energy firm

ERG SpA, which completed its multiyear transition

‘from black to green’ halfway through 2023 — selling off its last fossil-fuel

asset after announcing its plans in 2013 to transition from being an oil-and-gas

to a clean-energy company.

“When we first did the Global 100 ranking 20 years ago, the ‘green economy’ was

a quaint idea,” Heaps says. “It is now the overwhelming driver of global

economic growth, and we are enthusiastic that the Global 100 will continue to

lead the way over the next 20 years and beyond.”

Get the latest insights, trends, and innovations to help position yourself at the forefront of sustainable business leadership—delivered straight to your inbox.

Sustainable Brands Staff

Published Jan 17, 2024 2pm EST / 11am PST / 7pm GMT / 8pm CET