In May 2023, 17

companies

— AB InBev, Alpro (part of Danone), Bel, Carrefour,

Corbion, GSK, H&M Group, Hindustan Zinc Limited, Holcim

Group, Kering and L’Occitane Group (which in 2022 joined forces to

launch a Climate Fund for

Nature),

LVMH, Nestlé, Neste Corporation, Suntory Holdings Limited,

Tesco and UPM — representing various sectors and supply chains

significantly impacting nature, embarked upon a unique journey: piloting the

first-ever science-based targets for

nature.

Central to the pilot is determining the optimal balance between rigor and

feasibility, ahead of opening the target validation process up more broadly to

companies later this year. The pilot companies have contributed a wealth of

data, totaling over 20,000 data points.

In the final stages of this pilot — which concludes in May 2024 and will yield

the first validated targets — the Science-Based Target

Network (SBTN) has highlighted

initial

insights

gathered during the pilot through a combination of workshops, interviews and

anonymized surveys.

Alongside this official pilot, there are approximately 160 companies preparing

to set science-based targets for nature in some form; including 125 from SBTN’s

Corporate Engagement

Program,

plus companies working through partners including SBTN’s referral

program.

Below are five insights from pilot companies about lessons learned from

operationalizing science-based targets for nature.

Insight #1: Opportunities beyond risk management

Pilot companies value science-based targets for nature as a risk-management tool

to increase resilience, but also see opportunities beyond this.

As articulated by one pilot company:

“These methods provide value in the form of risk mitigation — identifying

risk along the supply chain — as well as improved reputation and competitive

advantage.”

The pilot companies are recognizing that the targets can be a catalyst for

change:

“This approach is a first step towards a standardization of how nature is

integrated into companies’ strategies. It’s an enormous step forward.”

GSK highlighted the “immense value of the framework” deepening the company’s

understanding of its impacts and dependencies on nature, and helping it to

refine and prioritize the action it is taking to meet its existing nature

targets.

Pilot companies also appreciate the interoperability of SBTN with other related

sustainability

initiatives.

As Bel advised:

“By doing SBTN, you are paving the way for other frameworks — at least from

a data perspective, the process is extremely rigorous and science-based.

Climate and nature are deeply interrelated; SBTN gives us a clear pathway to

create a resilient food model.”

Alpro emphasized SBTN’s alignment with the Taskforce on Nature-related

Financial Disclosures (TNFD) — whose

recommendations over 300 companies recently

committed

to adopt and begin publishing TNFD-aligned disclosures as part of their annual

corporate reporting — and its establishment as a standard for action on nature:

“This is striking a chord with leadership, and we are seeing the business

value of setting targets in this pilot.”

Insight #2: Validating and raising ambition

Kering highlighted the pilot’s impact on its ambition to have a net-positive impact on biodiversity by 2025:

“If you’re not talking about systemic transformation or collaborative

transformation, it’s very hard for you to raise your own ambition as well.

We think there’s so much promise and huge value [in these methods].”

The methods are encouraging companies to expand their scope of measuring their

environmental impacts from solely direct operations to include upstream. Holcim

says it is establishing the first-of-its-kind targets for upstream activities.

GSK noted a significant transformation driven by the process of setting

science-based targets for nature, which is engaging with suppliers to increase

traceability and data transparency on where and how materials are sourced —

which are “often well beyond the suppliers we procure directly from.”

Another pilot company reported the methods are not only helping it increase its

sustainability ambitions but also validate current ones; and the newfound

understanding of the organization’s impacts and dependencies on nature is

helping change mindsets internally regarding the urgency of meaningful action.

Companies are also evaluating a wider range of environmental impacts:

“Piloting science-based targets for nature has helped us identify areas

where we can strengthen our existing climate-focused initiatives, such as

our forest-positive and regenerative-agriculture

programs,

to better respond to nature-related risks and opportunities across our value

chain.” — Conor

McMahon, Global Net Zero and Nature Lead at Nestlé

This integrated assessment of nature impacts alongside climate has led some

companies to identify raw materials that, despite minimal GHG emissions, exert

significant impacts on nature.

Insight #3: Measurable benefits

The process of assessing and prioritizing value chain impacts on nature (Steps

1 & 2 of the

methods)

requires companies to increase their upstream traceability and work more closely

with suppliers to understand their impacts. The process has led companies to

uncover hidden risks within their supply chains — prompting them to prioritize

action in locations where it really matters.

For example, while the first freshwater-quality

targets

focus on nutrient pollution, the target-setting process requires a comprehensive

assessment of collecting water-pollution data. During this process, one company

discovered an issue with the use of herbicides within a specific basin that

adversely impact water quality. As the scope of freshwater-quality targets

expand in the future, the company will be able to set a science-based target to

address this issue. In the meantime, it is collaborating with suppliers to

mitigate this negative impact.

In addition to risk mitigation, several companies have also experienced a

cascading effect in engagement and collaboration — both internally and

throughout the supply chain. This has included capacity-building initiatives

with suppliers to gather more granular data.

Furthermore, setting science-based targets for nature has generated tangible

quantitative business

outcomes

for some. For instance, Hindustan Zinc is strategically planning to achieve cost

savings through enhanced water use efficiency; and another pilot company advised

that having credible nature targets is leading to easier access to credit and

financing.

Insight #4: Balancing rigor and feasibility

Governments

are increasingly pushing for ambitious upstream value-chain assessments,

including of high-impact

commodities.

SBTN’s methods align with the direction all companies need to pursue to halt and

reverse nature loss and remain aligned with the increasing scrutiny and

standards.

But governments aren’t the only stakeholders increasingly looking to hold

companies accountable. As observed by Holcim: “Investors are asking for this.

The extended stakeholders are waiting for it.”

SBTN aims to find the balance between what is currently feasible for companies

and what will elevate the level of ambition of action for nature — an ongoing

challenge that requires continual optimization.

One illustration of this challenge highlighted by the pilot lies in the

necessary place-based emphasis of science-based targets for nature, and

therefore the need for upstream traceability. Companies face obvious challenges

to get full visibility, with data collection and data quality presenting notable

hurdles.

As the landscape for data and tools to address nature

loss

is less mature than that for climate, SBTN is collaborating with developers to

identify relevant tools and data, and creating additional guidance to help

companies build traceability in their supply chains.

The tension between scientific rigor and practical application extends to

sector-specific considerations. SBTN’s value-chain-assessment methodologies are

designed to be cross-sector to allow for broad corporate engagement; but some

companies have expressed a need for methods to be more flexible and tailored to

their particular industry realities.

To further facilitate implementation, SBTN is looking to enhance existing

methods through sector-specific on-ramps and validation guidance at critical

parts of the methodologies.

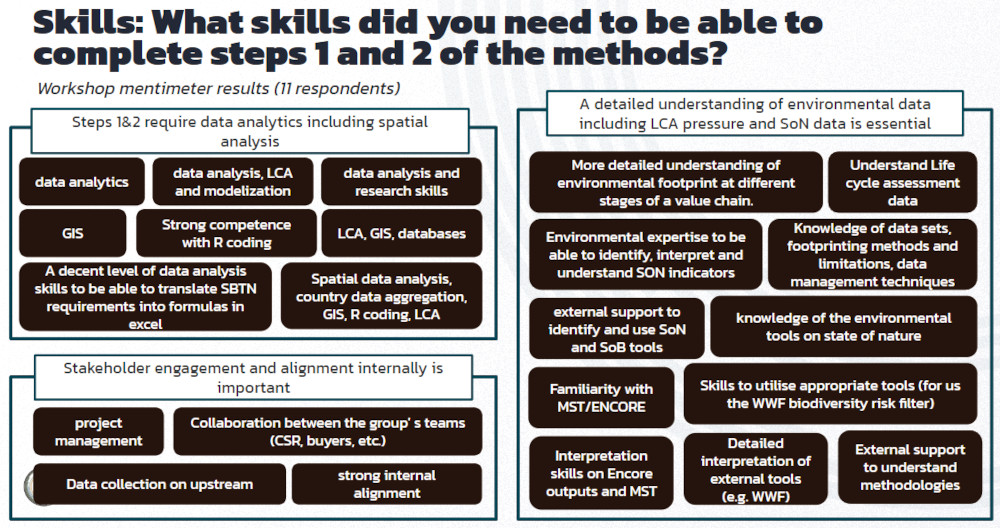

Insight #5: People at the core: Skills, expertise and collaboration

As pilot companies have pointed out, successful implementation hinges not just

in the methodologies but in the people who bring them to life (see image below).

Skills such as expertise in lifecycle assessment and footprinting, proficiency

in spatial analysis, and deep understanding of environmental data are crucial.

These can be built within a company or alongside the assistance of a

consultant.

Image credit: SBTN

Image credit: SBTN

But just as important as technical know-how is the internal buy-in and support

required to ensure the successful collection of data — for example, effective

coordination with procurement departments on upstream data. This is particularly

true for large companies sitting downstream of the value chain.

In recognition of this, SBTN is preparing additional

resources to support

companies through the onboarding journey — including its forthcoming Corporate

Manual, designed as a practical introductory guide to SBTN’s methods; as well as

a self-assessment tool to support companies in their preparations to begin the

process.

What’s next

Pilot companies are set to submit their targets for validation by March 1, 2024.

SBTN anticipates the first validated targets by May/June, to be accompanied by a

detailed report outlining key learnings and insights from the pilot.

In preparation for a broader roll-out of the target-validation process, a

priority is establishing a robust validation model — which is being developed in

collaboration with ISEAL — and SBTN will

continue its collaborative efforts to further align with other related

sustainability frameworks, including TNFD.

By 2025, companies can expect additional coverage of science-based targets for

nature — including the first ocean targets and expanded targets on freshwater

pollution and land — with further biodiversity metrics, indicators and

safeguards integrated.

Get the latest insights, trends, and innovations to help position yourself at the forefront of sustainable business leadership—delivered straight to your inbox.

Sustainable Brands Staff

Published Jan 24, 2024 2pm EST / 11am PST / 7pm GMT / 8pm CET