Building new homes in disaster danger zones could cost billions, threaten affordability

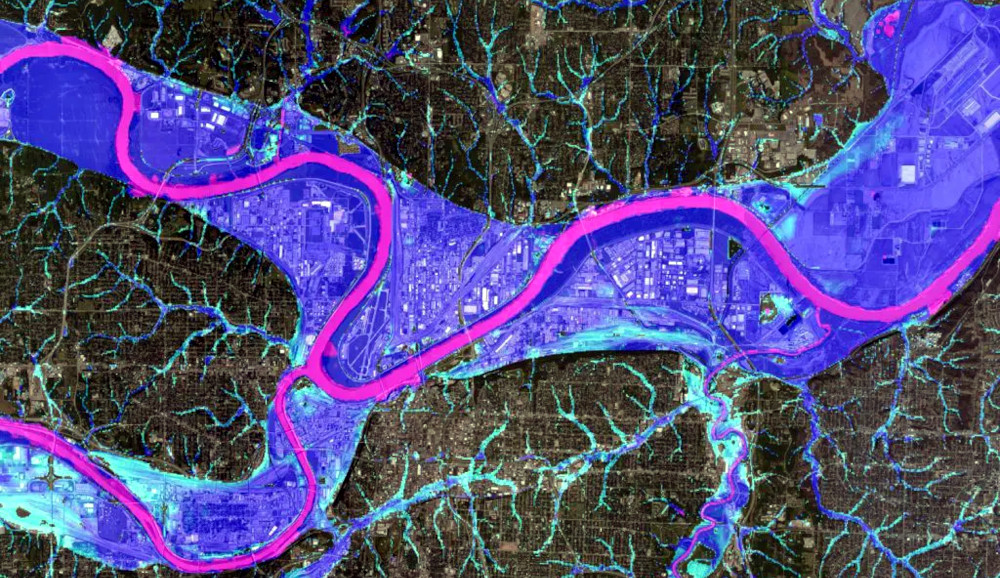

Image credit: Fathom

Global

Image credit: Fathom

Global

As is the case in most developed countries, governments across Canada are

racing to build more housing to improve affordability. Yet a new study from the

Canadian Climate

Institute

has found those efforts risk putting hundreds of thousands of homes in harm's

way — and adding billions of dollars in costs each year — unless policy is

improved to direct development away from the threat of wildfires and floods.

As Close to Home: How to build more housing in a changing

climate

outlines, building new homes in areas at a high risk of flood or wildfire could

cost governments, insurers and homeowners up to $3 billion more each year for

rebuilding and disaster relief. These risks are neither distant nor abstract:

Damages from just four extreme-weather events in July and August 2024 —

flooding

in Toronto and Southern Ontario, the catastrophic

wildfire

in Jasper, extreme

flooding

in Quebec and an historic

hailstorm

in Calgary — totaled more than $7 billion in insured

losses.

One of the most striking findings of the study is that most of the projected

costs are associated with a relatively small number of homes expected to be

built in flood-vulnerable zones: Redirecting just three percent of new homes

away from the highest-risk flood areas could save nearly 80 percent of all

projected weather-related losses by 2030.

"The most affordable home is the one you don't have to rebuild after a disaster.

Governments across Canada can save billions of dollars each year and keep people

safe from disasters by building just a small percentage of new homes away from

the highest-risk areas for wildfires and floods,” says Ryan

Ness, Director of Adaptation

at the Canadian Climate Institute. “Our new report outlines the tools

policymakers have to steer new housing to safer ground and support affordability

in the process."

The report — which includes wildfire-risk analysis from Canadian financial

services firm Co-operators, flood-risk modeling

by Fathom Global and future housing risk analysis

by SSG — is a first-of-its-kind analysis in Canada to model

the financial costs of future floods and fires on new housing slated for

construction by 2030.

It finds that more than 540,000 homes could be built in areas of flood hazard

and more than 220,000 homes in locations exposed to high wildfire hazards by

2030. The associated total costs are likely to be highest in British

Columbia — which faces $2.2 billion in added annual costs under a worst-case

scenario — followed by Manitoba ($360 million), Alberta ($220

million), and Quebec ($214 million). The Yukon could see increases in

average damages as high as $1,200 for each new home from flooding alone, well

beyond the national average.

The Climate Institute also commissioned a companion report, Indigenous

Housing and Climate

Resilience,

by Shared Value

Solutions

to identify unique challenges and barriers faced by Indigenous Nations in

developing climate-resilient homes, with a particular focus on housing on First

Nations reserves. The report examines successful policies and practices, and

presents nine policy recommendations.

"Solving Canada's housing crisis requires not just building more homes but

ensuring they're affordable in the long term. This includes building new homes

in safe locations that are resilient to increasingly severe floods and

wildfires,” asserts Lisa Raitt,

Vice-Chair of Global Investment Banking at

CIBC and Co-Chair of the Task Force for

Housing and Climate. “This new Climate Institute

report highlights the financial risks Canada faces if housing policy continues

to allow risky development, and offers actionable solutions to protect people

and property."

The report notes that all levels of government have a role to play in reducing

the threats of extreme weather disasters to new homes, and offers these policy

recommendations:

-

Federal, provincial and territorial governments should steer housing and

infrastructure investment away from high-hazard zones to low-hazard areas.

-

Provincial and territorial governments should strengthen land use policy to

redirect new construction away from areas at high risk of flood and fire

damage.

-

Federal, provincial and territorial governments should reform

disaster-assistance programs to deter risky development — for example, by

making new homes built in high-hazard zones ineligible for publicly funded

disaster compensation.

-

Governments should create, maintain and make publicly available maps that

show hazardous areas — and mandate the disclosure of such information in

real estate transactions — so that homeowners, renters and developers have

access to that knowledge.

-

The federal government should empower and support Indigenous communities to

build climate-resilient

homes

in safer areas within their territories.

"Local governments, at the forefront of both the climate and housing crises, are

essential partners in safeguarding Canadians and protecting communities from

escalating climate impacts,” says Carole

Saab, CEO of Federation of Canadian

Municipalities. “This report highlights the urgency of coordinating across all

orders of government and sectors to keep Canadians and their homes safe from

increasingly severe wildfires and floods."

Climate-driven migration, insurance increases could erase $1.4T in US real estate value by 2055

The LA fires, January 2025 | Image credit: Maxar

The LA fires, January 2025 | Image credit: Maxar

Meanwhile, First Street’s just-released 12th

national report estimates a potential $1.47 trillion reduction in US real

estate value over the next 30 years due to climate-related risks.

First Street uses transparent, peer-reviewed methodologies to quantify the past,

present and future climate risk for properties globally and makes it available

for citizens, industry and government. In October, Zillow began offering

First Street’s data for five key climate-related

risks

on all for-sale property listings across the US — helping buyers to better

assess long-term affordability and plan for the future.

Drawing on interdisciplinary research that examines climate risk awareness,

housing market dynamics, climate migration patterns, and demographic and

socioeconomic shifts, First Street’s new Property Prices in

Peril report

offers a forward-looking analysis of the Housing Price

Index,

property-valuation trends and localized GDP impacts extending to 2055.

Key findings

-

By 2055, climate-driven weather phenomena are expected to increase homeowner

insurance premiums nationwide by an average of 29.4 percent — the five

largest metro areas facing the highest insurance premium increases are Miami

(322 percent), Jacksonville (226 percent), Tampa (213 percent), New Orleans

(196 percent), and Sacramento (137 percent).

-

Simultaneously, migration induced by climate risks including extreme heat,

wildfire and flooding is anticipated to drive significant population

redistribution, with 55 million Americans expected to relocate within the US

over the same period to historically less populous states such as North

Dakota and Montana — which are forecasted to grow due to their climate

resilience.

“Climate change is no longer a theoretical concern; it is a measurable force

reshaping real estate markets and regional economies across the United States,”

said Dr. Jeremy Porter, Head of

Climate Implications Research at First Street. “Our findings highlight the

urgent need to understand how rising insurance costs and population movements

are transforming the economic geography of the nation.”

The study projects a stark divergence in property values: High-risk areas are

likely to experience significant devaluation, while regions perceived as

climate resilient are

poised to benefit from increased demand. This reallocation of economic activity

will have profound implications for local government revenues — with at-risk

areas facing reductions in property tax income, while more resilient areas stand

to gain.

“These results highlight not only the pressing challenges but also the

opportunities for adaptation and

innovation

in the face of climate change,” added First Street founder and CEO Matthew

Eby. “Policymakers, businesses and

communities must act now to mitigate risks and capitalize on the emerging

economic opportunities in a shifting landscape.”

Get the latest insights, trends, and innovations to help position yourself at the forefront of sustainable business leadership—delivered straight to your inbox.

Sustainable Brands Staff

Published Feb 7, 2025 8am EST / 5am PST / 1pm GMT / 2pm CET