Are you familiar with the “window of

vitality”?

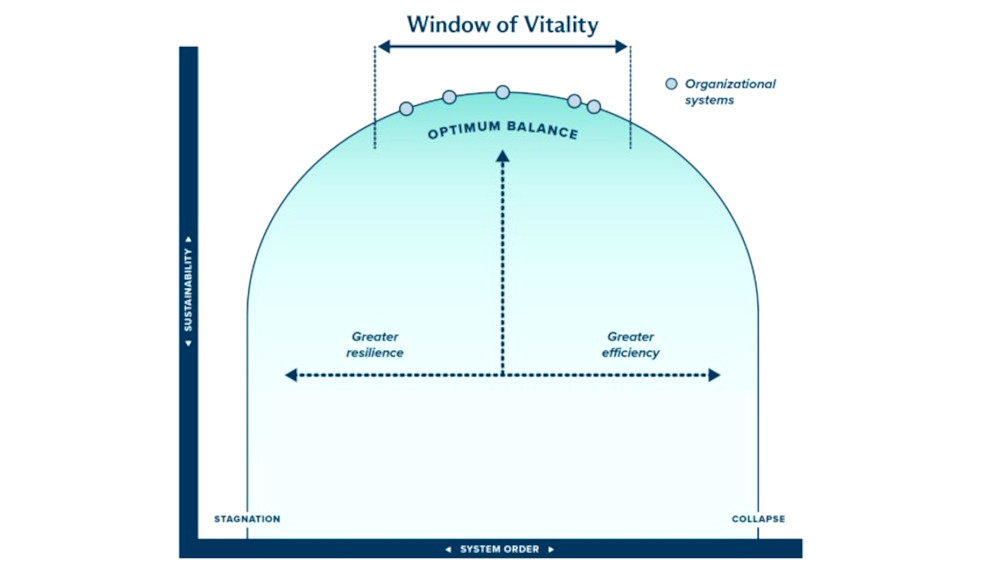

It refers to the idea that functioning ecosystems exist within a range of what

ecologists call “system

order.”

These ecosystems avoid breaking down over time because they balance efficiency

(the optimum use of resources) with resilience (the capacity to adapt to

change).

To illustrate the concept, let’s take an example from urban planning — where

swamps and creeks are concreted over to support housing and infrastructure

development. Most years, this ‘solution’ deals well with light to moderate

rainfall by allowing excess water to drain quickly and efficiently. When the

deluge comes, though, the impervious surface prevents groundwater

recharge

— water percolating through microscopic gaps in rock and soil to the aquifer

below — overwhelming the stormwater system that functions so well in standard

conditions and mass flooding devastates the precinct.

Urban planners now recognize the importance of water-sensitive urban

design, which

minimises wastewater and preserves waterway health and groundwater recharge.

Unfortunately, broader corporate culture has been slower to learn such

principles — tending to overinvest in efficiency (draining waterways) at the

expense of resilience (preserving waterways).

Mired in the short-termism of the quarterly earnings cycle, many investors and

company bonus structures incentivize management teams to optimize for cost and

efficiency. More common still is the assumption that the future will be the same

as the recent past. This also spurs executives to prioritize efficiency over

resilience (which assumes change).

By contrast, the hallmarks of

resilience

— sustainability, flexibility, diversity and learning — are viewed as optional

at best and wasteful at worst.

The lesson from nature is that successful organizations stay within their own

window of vitality by understanding and balancing the tension between efficiency

and resilience.

A case study in Google

Consider Google, whose founders created one of the world’s most successful

businesses by allocating a meaningful portion of firm resources to

‘non-productive’ innovation.

Borrowing the idea from 3M, co-founders Sergey Brin and Larry

Page

instituted the 20%

Project — where

employees were encouraged to spend up to a fifth of their time working on

personal projects. In a culture that prized individual freedom and celebrated

creativity, employees invented cash-gushing creations including AdSense,

Gmail and Google News.

Ironically, the 20% Project was discontinued in 2013 after excessive management

oversight of new ideas and an overt focus on efficiency stifled its intended

innovation.

In the decade since, Google has trended further towards hyper-efficiency at the

expense of the blue-sky thinking of its engineers. OpenAI’s

ChatGPT,

for example, leapfrogged Google Bard in the race to

monetize large language models — despite the latter having deeper pockets and

more AI talent.

CEO Sundar Pichai and CFO Ruth Porat remain outstanding business

leaders. But in my view, they can do more to ensure Google remains within the

window of vitality.

Restoring an optimum balance between efficiency and resilience at Google might

include the following steps:

-

Restart the 20% Project: Explain to investors that short-term costs are

the price of creativity and innovation, and a necessary bulwark against

future disruptions.

-

Minimum percentage of investment for ‘other bets’: Defend moonshot ideas

such as Waymo (self-driving cars) and

Calico (longevity) from the vagaries of the

economic cycle.

-

Modularize project teams: Hire and promote people especially good at

adapting to change and faster cycles of knowledge acquisition.

-

Invest in resilience: Set aside a resilience fund to respond quickly to

unforeseen future disruptions and to support the evolution of the business

model over time.

-

Talent redistribution:

AI is

undermining the value of average engineers. Trim the engineering team and

reinvest in other disciplines (e.g. physics, sustainability).

-

Ethical use of AI: Work with major competitors to develop a framework to

guide the development and use of AI to ensure AI-generated content is

accurate and safe.

-

Invest in trust: Use DeepMind to showcase

how AI can help solve humanity’s greatest challenges — burnishing Google’s

reputation as a champion for the common good.

3 steps to bolster your company's resilience

Like Google, has your business over invested in efficiency at the expense of

resilience? If so, what steps can you take to right the balance? Here are three

to consider:

-

We recommend a megatrends analysis as part of the materiality-assessment

process, to better understand

how changes in the operating environment might affect your business.

-

Science-based climate-scenario

analysis

is another critical strategy that will help you prepare for an unknown

future. Disclosure is now mandatory in many jurisdictions.

-

Finally, consistent reporting on ESG performance can ensure your

organization sees the bigger picture — allowing it to learn and adapt over

time.

As Nassim Taleb says,

“Never cross a river if it is, on average, four feet deep.” To succeed over the

long term, always prepare for the flood.

Get the latest insights, trends, and innovations to help position yourself at the forefront of sustainable business leadership—delivered straight to your inbox.

Luke Heilbuth is CEO of BWD — a sustainability advisory firm with offices in Sydney and New York.

Published Jan 28, 2024 8am EST / 5am PST / 1pm GMT / 2pm CET