Despite ongoing efforts from the new US administration to eradicate even the

mention of ESG- and climate-related activities, the results of three new surveys

of CFOs and execs across a range of industries and geographies show that the

business world seems — for now, at least — to be standing firm in its support of

good business.

BDO: CFOs see advantages of corporate sustainability

Image credit: BDO

Image credit: BDO

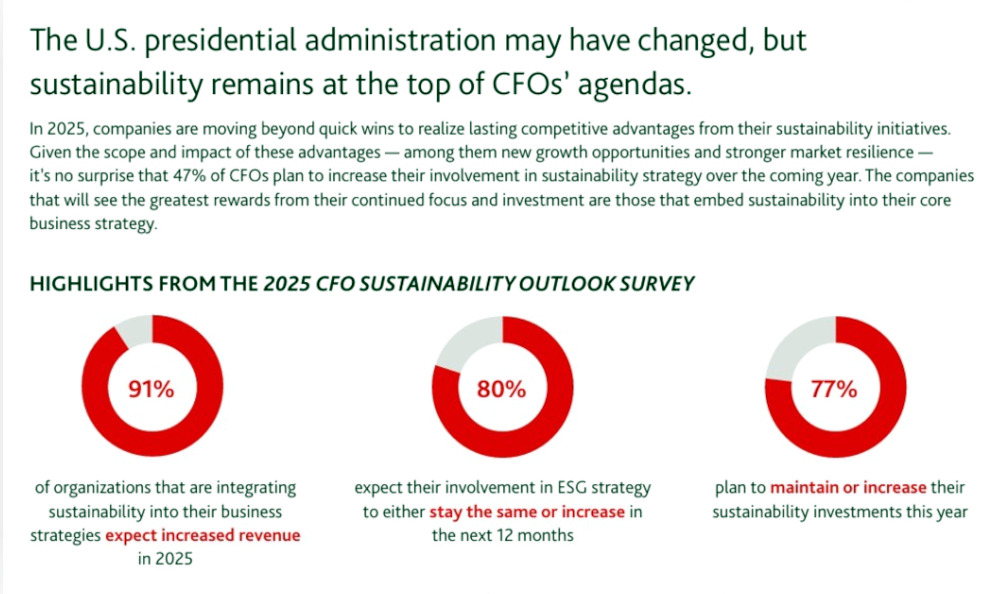

According to BDO’s 2025 CFO Sustainability Outlook

Survey

— which polled 500 US-based chief financial officers (CFOs) across life

sciences, healthcare, manufacturing, retail and technology —

companies that integrate sustainability into their core business strategy are

significantly more likely to project increased revenue and profitability

compared to their peers.

Understanding the business case

Respondents report measurable

returns from

their corporate sustainability initiatives, from revenue growth to improved

access to financing. These tangible benefits are reshaping how businesses view

sustainability investments, shifting the conversation from "whether to invest"

to "how much."

In one standout statistic, 91 percent of organizations that are integrating

sustainability into their business strategies expect increased revenue in 2025,

versus just 74 percent of their peers.

“A sustainable business is stronger, more responsive to stakeholder

expectations, and more resilient to economic headwinds,” said Karen

Baum, Managing Principal;

Sustainability & ESG Center of Excellence at BDO USA; Sustainability Services &

Solutions at BDO Global. “When businesses move sustainability off the sidelines

and integrate it into core business strategy, they create a strong offense –

unlocking innovative growth pathways while defending against shifting market

conditions.”

Organizations see many benefits from their sustainability initiatives, but

capturing full value requires the strategic integration of a focused

sustainability strategy. To realize ROI from their sustainability investments,

BDO suggests CFOs consider the following actions:

-

Identify industry-specific opportunities. Benefits from sustainability

initiatives vary significantly by sector. Develop benchmarks against

industry peers to identify the most relevant and achievable benefits for

your organization, then build targeted initiatives to capture that value.

-

Balance short- and long-term priorities. A targeted sustainability

strategy captures immediate operational gains while establishing the

foundation for broader transformation. Design your roadmap to achieve quick

wins alongside systematic progress toward long-term financial and

non-financial

goals.

-

Find opportunity in risk. ESG risks are interconnected with other

business risks — and may reveal inefficiencies or gaps that lead to

innovation. Use materiality

assessments

to not only prioritize key risks, but also to uncover strategic

opportunities for growth.

“Moving into 2025, it's clear CFOs are not just adapting to change but are

actively embracing it and helping shape their organization's response,” said

Wayne Berson, CEO of BDO USA. “The

bold steps being taken in AI,

workforce development, and sustainable operations are not merely reactions to

market pressures — they are strategic moves to refine and redefine how leaders

are conducting business. By embracing innovation and prioritizing

resilience,

these leaders are setting a new trajectory for growth.”

Kearney: 69% of CFOs expect higher ROI from sustainability initiatives than from traditional investments

Image credit: Vitaly Gariev

Image credit: Vitaly Gariev

BDO’s findings echo that of

Kearney’s

recent survey of more than 500 CFOs, which reveals that 69 percent expect higher

returns on sustainability initiatives compared to traditional investments.

The research surveyed 500 CFOs across India, the UAE, UK and US

to understand how they are embedding sustainability within their strategies.

Conducted in partnership with climate media platform We Don't Have

Time, the findings of Staying the Course:

Chief Financial Officers and the Green

Transition

highlight CFOs' confidence in the long-term value and profitability of

sustainable investments despite growing geopolitical volatility and increased

financial pressure. Adding to this optimism, 92 percent expect their

organizations to significantly increase net investment in sustainability this

year.

Financial risks and business cases

According to the research, 93 percent of CFOs recognize the business case for

sustainability and climate

investments.

However, the survey reveals varying motivations behind these investments: 61

percent still view these sustainable investments through a cost-focused lens,

rather than considering the long-term value they may generate.

On a positive note, 65 percent of CFOs are now acknowledging and measuring the

cost of

inaction

— signaling an increasing awareness of the long-term risks posed by climate

change and regulatory penalties, as well as opportunities related to green

transition.

The research highlights that CFOs are focusing on sustainability investments

that offer clear, short-term benefits in reducing emissions. The top three

highest-ranked investment areas are:

-

Increasing the use of sustainable

materials

-

Driving sustainable

innovation and

partnerships

-

Enhancing energy

management

and waste

reduction

Workforce and investment strategies

CFOs are also responding to increasing pressure from employees to align their

financial strategies with sustainable practices, with more than 71 percent of

CFOs considering sustainability when selecting employee retirement

funds.

The findings suggest that CFOs also still recognize the value of sustainable

investments that both benefit the planet and resonate with values-driven

investors and employees: An overwhelming majority (94 percent) say they now

incorporate sustainability considerations into broader investment decisions.

As Beth Bovis, Partner and

Global Sustainability Lead at Kearney, pointed out: "The perspective of CFOs is often

overlooked in the corporate sustainability debate, yet their role is crucial. As

those in control of financial levers, CFOs are uniquely positioned to have a

long-term impact on business strategy. And our study highlights that they're

already taking steps in this direction.

"ESG reporting is increasingly falling under the CFO's responsibilities. But

beyond simply ensuring regulatory compliance, CFOs can lead the charge in

driving investments that not only reduce emissions but also deliver tangible

commercial value for the business."

"Finance chiefs are increasingly absorbing more of their organization's

sustainability efforts, and our research shows that they are more than prepared

for this responsibility,” said Ingmar

Rentzhog, Founder & CEO at We Don't Have

Time. "Looking ahead, with the UK government set to release its Sustainability

Disclosure

Standards

this year, organizations will be forced to rethink how they measure and

communicate their climate initiatives. CFOs will be crucial in navigating these

changes, as they must assess and disclose their environmental impact — adding a

new layer to financial reporting."

Workiva: Execs remain committed to integrating financial and sustainability data, despite policy uncertainty

Image credit: Antoni Shkraba

Image credit: Antoni Shkraba

Meanwhile, respondents to Workiva’s recent poll of a broader range of

executives believe companies that integrate financial and sustainability data

are gaining a competitive edge.

When Workiva surveyed 1,600 global C-suite executives and VPs in finance and

accounting, sustainability, internal audit, and legal departments — as well as

222 institutional investors — for its 2025 Executive

Benchmark,

97 percent of executives said sustainability reporting will be a business

advantage within two years, and 96 percent of investors agreed it strengthens

financial performance; and they see integrated reporting as essential for

resilience and growth.

“CEOs are making choices today that will shape their business for years to

come,” said Workiva CEO Julie Iskow.

“Assured financial and sustainability reporting is not simply a compliance play

— it's a strategic approach to mitigate risk, fuel performance and strengthen

investor confidence.”

Investors are responding. “The market has spoken, and forward-thinking companies

aren’t waiting — they’re taking action and committing to science-based targets

and stronger disclosures,” said Tensie

Whelan, Distinguished

Professor of Practice for Business and Society and Founding Director of the NYU

Stern Center for Sustainable

Business.

“They understand that sustainability and integrated reporting isn’t just about

risk management — it’s a competitive advantage that attracts capital and drives

long-term success.”

Key findings:

-

97 percent of executives say integrated financial and sustainability data

helps identify performance gaps that enhance financial growth opportunities.

-

85 percent will move forward with climate disclosures, regardless of

political

shifts.

-

92 percent of investors rank data accuracy as a foundational requirement to

effectively evaluate organizations, yet nearly a quarter of executives do

not fully trust their financial data.

-

93 percent of institutional investors are more likely to invest in companies

with integrated financial and non-financial reporting.

“Other Chief Financial Officers and Chief Executive Officers that I talk to

believe that sustainability is something that we cannot ignore,” said CEMEX CFO

Maher Al-Haffar. “Sustainability

is incredibly important because it contributes to the profitability of the

business. As a CFO, I’m trying to get my hands around how to provide data for

investors so that they can quantify it and model it.”

The results of all three surveys and recent actions by global leaders

demonstrate that despite market complexities, executive commitment to meaningful

sustainability action continues to accelerate — driven by clear evidence of its

strategic and financial value.

Get the latest insights, trends, and innovations to help position yourself at the forefront of sustainable business leadership—delivered straight to your inbox.

Sustainable Brands Staff

Published Feb 21, 2025 8am EST / 5am PST / 1pm GMT / 2pm CET