The recently released third iteration of an annual ESG reporting survey showed

that, while it remains a contentious topic in some circles, most companies are

planning for a future of widespread and more transparent reporting.

Workiva’s 2024 ESG Practitioner

Survey — which compiled the

thoughts of more than 2,000 professionals working in ESG reporting at the

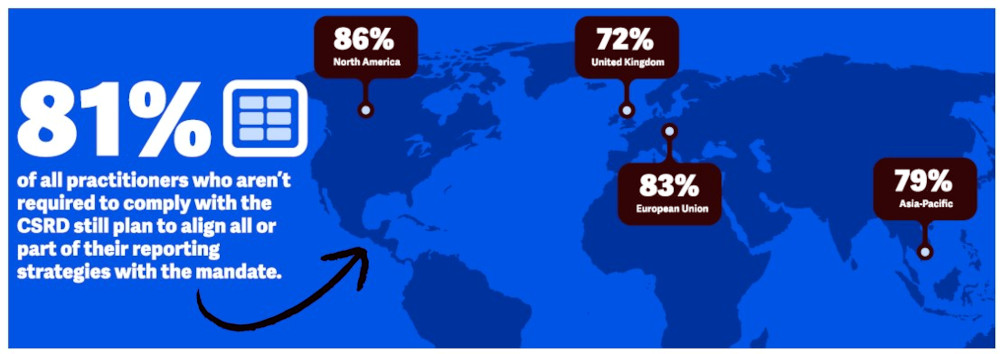

manager level or above — found that at a very basic level, 81 percent of

companies surveyed not subject to the EU’s Corporate Sustainability Reporting

Directive

(CSRD) were planning to comply with it anyway. What’s more, 92 percent of

companies are investing more in reporting to meet these and other upcoming

guidelines, including those in the US.

“It’s telling how global regulations are becoming the norm,” Mandi

McReynolds, Workiva’s chief

sustainability officer and VP of global ESG, told Sustainable Brands®

(SB).

The survey was done in March, so it doesn’t necessarily take into account the

recent SEC’s rollout of its climate-disclosure

rules

and the almost-immediate, associated legal

challenges.

Neither McReynolds nor Ascend2 CEO Todd

Lebo, whose company carried out the

research, says that that development would have necessarily affected the results

because the surveyed companies were already doing some level of reporting.

Where the challenges begin to arise is in the actual reporting process and the

confidence these professionals have in getting the data right. While 98 percent

of respondents think their ESG data is accurate, 83 percent say collecting

accurate data to meet the CSRD requirements is going to be a challenge for their

organization.

Image credit: Workiva

Image credit: Workiva

Near the top of the list of those challenges are complying with these

ever-changing mandates and aligning with stakeholder needs. There are also

issues with the sheer volume of requirements: Some organizations are set up to

manage it all; others are not.

In this edition of the survey, Lebo told SB they made sure they involved people

inside and outside ESG/sustainability functions but had a qualifying question to

ensure respondents were involved in reporting in some capacity.

“It gave us a more holistic view,” he said.

This range of the corporate ladder highlighted differences in reporting

perception between executives and non-executives. 62 percent of executives

thought that their company applied “the same diligence” to ESG reporting as they

did financial reporting; however, that number dropped to 32 percent for

manager-level employees. The numbers were generally similar when discussing

perception of a company’s

materiality-assessment

and report-drafting processes. Between executives and those lower in

organizations, the perception gap is clear.

Overall, the report showed that companies are moving ahead in reporting —

whether to meet CSRD or generally to meet consumer expectations. However, the

constant change in reporting requirements is causing corporate grief as they try

to evolve to meet the standards of the moment and the “stakeholder demands for

transparency moving forward,” McReynolds said.

With Workiva being an ESG-reporting platform, it’s important to take the

company’s inherent lean towards a pro-reporting approach into account while

reviewing the report; but what’s clear is that across this survey group, more

investment in efficient reporting is on the horizon. 89 percent of companies are

planning to allocate more budget for “ESG initiatives” over the next three

years, with technology and

data

being a big part of that.

Increased investment will be required to meet upcoming requirements for

everything from materiality to emissions disclosures, regardless of a company’s

private or public standing.

As McReynolds asserted: “Better reporting will drive better business

performance, and increase the chances of meeting long-term ESG goals.”

Get the latest insights, trends, and innovations to help position yourself at the forefront of sustainable business leadership—delivered straight to your inbox.

Geoff is a freelance journalist and copywriter focused on making the world a better place through compelling copy. He covers everything from apparel to travel while helping brands worldwide craft their messaging. In addition to Sustainable Brands, he's currently a contributor at Penta, AskMen.com, Field Mag and many others. You can check out more of his work at geoffnudelman.com.

Published May 7, 2024 8am EDT / 5am PDT / 1pm BST / 2pm CEST