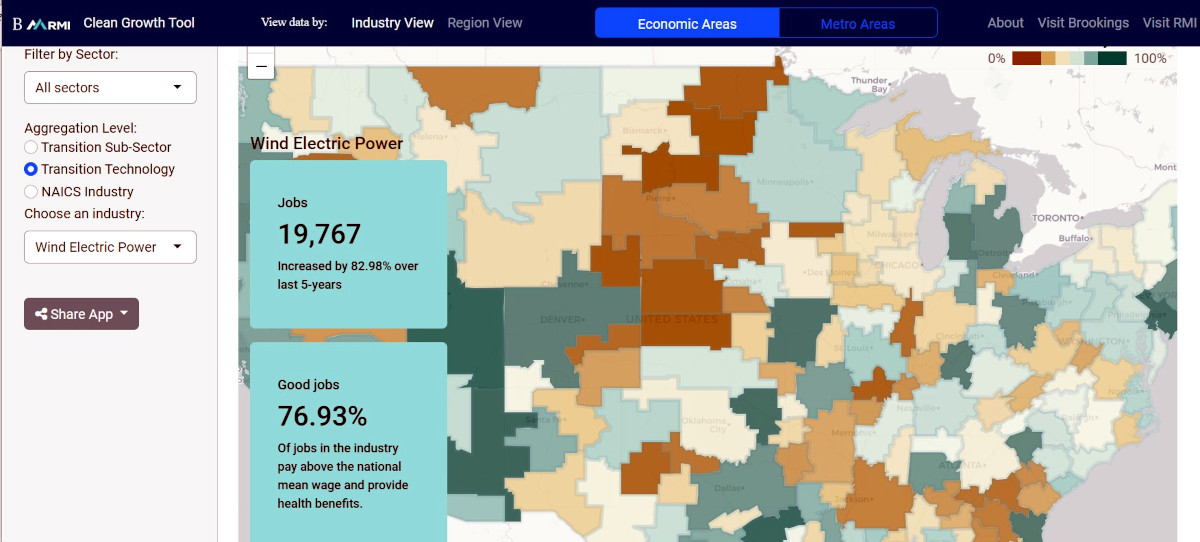

Nonprofit climate and cleantech research institute RMI

(founded as Rocky Mountain Institute) has launched the Clean Growth

Tool — a new analytical and data platform

that identifies the states, cities and regions where clean-energy industries are

most likely to thrive in the United States, given their existing workforce

strengths and related economic capabilities.

For example, RMI data from the Clean Growth Tool reveals that key regions in

Arizona, Georgia, Illinois, Michigan and North Carolina —

states that have attracted significant cleantech investment in the wake of the

Inflation Reduction

Act

(IRA) — are well-positioned to extend their industrial leadership in

manufacturing solar

components,

batteries

and electric

vehicles;

as well as the extraordinary potential that states including Idaho,

Kentucky, Minnesota, Ohio, Pennsylvania, Texas and Utah

have in these same and related critical industries.

The Clean Growth Tool builds on economic methods introduced

at

the Harvard University Center for International Development and workforce

development

research

at the Brookings Institution. It covers sectors, technologie, and industries

associated with all stages of energy transition and clean-energy supply chains.

It offers two geographic filters — metropolitan statistical area (MSA),

which includes cities and their immediate surroundings; and economic area

(EA), which

covers both urban and rural areas.

Image credit: RMI

Image credit: RMI

The Tool provides insights on the potential for development and manufacturing of

low-carbon solutions related to industries ranging from energy tech,

agricultural health and waste management to building & construction, vehicles,

metals and minerals, forestry, chemistry and more. It covers all 50 states —

providing policymakers and investors with the data they need to pursue the most

promising opportunities, and strengthen both local prosperity and US

competitiveness amid the accelerating global energy transition.

The launch of the tool comes on the heels of a survey conducted by the

Michigan Economic Development Corporation that shows the US public has a

clear

appetite

for the adoption of new, clean technologies — as well as business incentives,

training opportunities and robust career pathways to support this growing

economy.

“Cities and states need to know where it makes sense to invest to be most

competitive amid the global clean energy manufacturing boom,” said RMI senior

principal Aaron

Brickman.

“We’re giving policymakers and investors the workforce and industry data they

need to unleash their full potential, spur innovation, boost productivity and

create new export opportunities. America can successfully compete in the

manufacturing of not only emerging technologies like clean steel, but also

widely deployed ones like solar. Economic competitiveness is key to sustained

job growth in cleantech manufacturing, and we hone our competitive edge by

steering the right investments to the right places.”

As RMI points out in a

post,

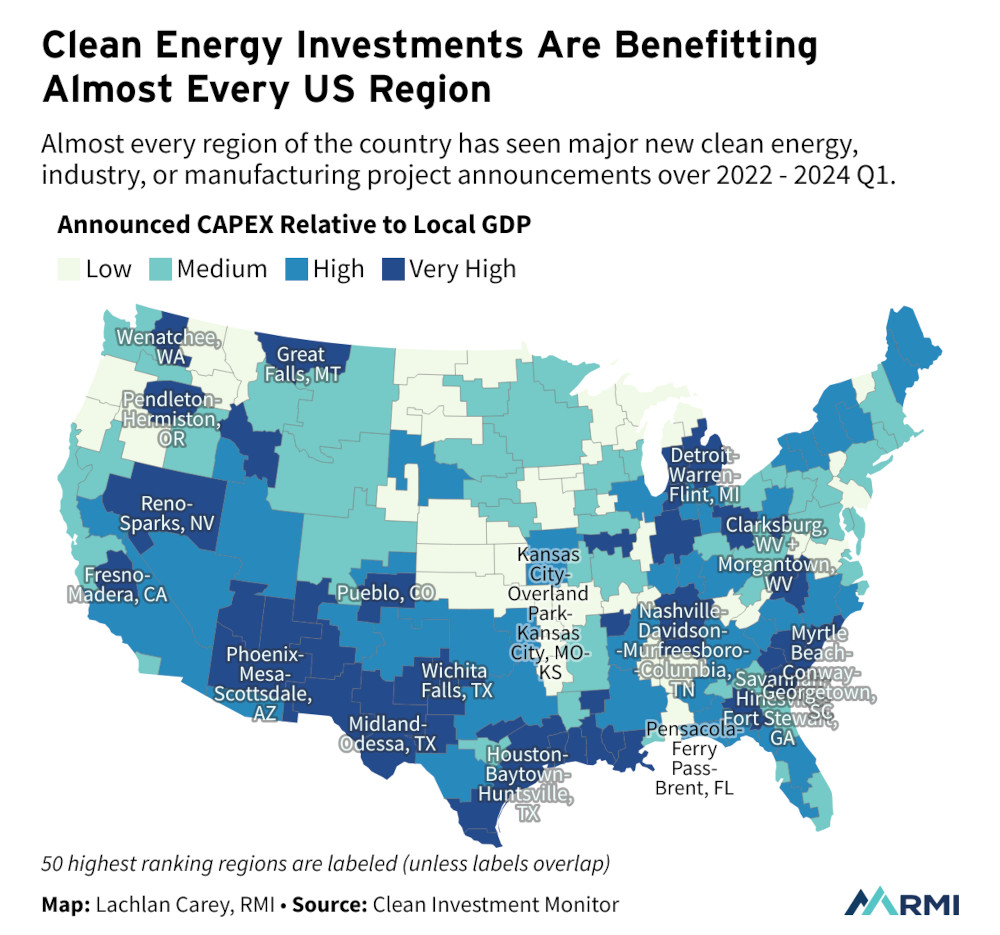

the growth of clean-energy investment in the US in the wake of the IRA has been

unprecedented. Hydrogen projects and battery and solar manufacturing are growing

especially quickly, thanks to a coordinated “green industrial

strategy”

that offers powerful investment subsidies, local content requirements and

low-cost financing to domestic producers.

Image credit:

RMI

Image credit:

RMI

Already, these investments are reaching almost every region of the country:

Whether it’s the “battery belt” extending from Michigan to Alabama, hydrogen

investments along the Gulf Coast, electric vehicles (EVs) and solar manufacturing

in the Southeast, or sustainable fuels in corn

country,

the energy transition is already fueling growth and opportunities nationwide.

Data source inputs for the Clean Growth Tool include the Clean Investment

Monitor (MIT/Rhodium), Smart

Growth Cities, the American

Community Survey,

Lightcast and the Green Transition

Navigator (LSE).

RMI will continue to update the Clean Growth Tool as new industrial,

technological, investment and policy information becomes available.

Get the latest insights, trends, and innovations to help position yourself at the forefront of sustainable business leadership—delivered straight to your inbox.

Sustainable Brands Staff

Published Aug 6, 2024 2pm EDT / 11am PDT / 7pm BST / 8pm CEST